Aluwind Architectural is offering 66 lakh new shares in its IPO, aiming to raise Rs 29.70 crores at a fixed price of ₹45 per share.

The IPO opens for subscription on March 28, 2024, and closes on April 4, 2024. Allotment is expected to be finalized by April 5, 2024, with listing on NSE SME planned for April 9, 2024.

To participate, investors need a minimum of 3000 shares, equivalent to an investment of ₹135,000. For HNIs, the minimum investment is 2 lots, totaling 6,000 shares or ₹270,000.

Corpwis Advisors Private Limited is managing the IPO, with Skyline Financial Services Private Ltd as the registrar. Nnm Securities serves as the market maker.

ABOUT ALUWIND ARCHITECTURAL

Aluwind Architectural Limited, established in April 2003, specializes in the manufacturing and installation of various aluminum products such as windows, doors, curtain walls, cladding, and glazing systems.

These products are meticulously crafted to cater to the unique requirements of architects, consultants, builders, institutions, and corporations.

The company has significantly expanded its market presence and currently serves customers across multiple cities in India, including Mumbai, Pune, Bangalore, and Hyderabad.

This broad geographical reach underscores its commitment to providing quality products and services nationwide.

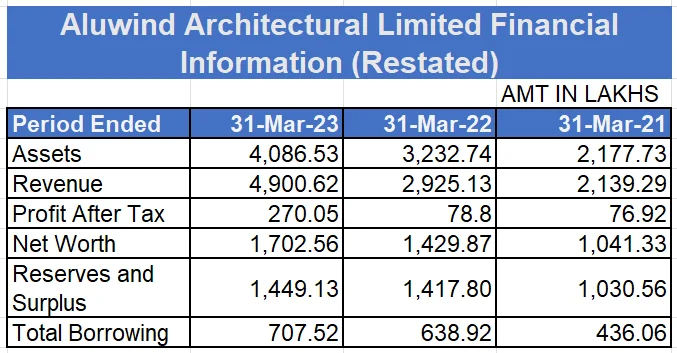

In terms of financial performance, the company reported profits after tax of INR 76.92L, INR 78.80L, INR 270.05L, and INR 372.83L for FY21, FY22, FY23, and H1 FY23, respectively.

Aluwind Architectural Limited operates from a manufacturing unit located in Pune, Maharashtra, covering an area of 45,000 square feet.

The company’s impressive client portfolio includes renowned real estate developers such as L&T and Birla, enabling it to secure diverse projects through competitive bidding processes.

As of September 30, 2023, the company boasted a workforce of 178 permanent employees.

It places a strong emphasis on employee training to enhance operational efficiency, boost productivity, and uphold quality and safety standards across its operations.

ALUWIND ARCHITECTURAL IPO DETAILS

IPO Date: March 28, 2024, to April 4, 2024

Listing Date: [Not specified yet]

Face Value: ₹10 per share

Price: ₹45 per share

Lot Size: 3000 Shares

Total Issue Size: 6,600,000 shares (amounting to ₹29.70 Cr)

Fresh Issue: 6,600,000 shares (amounting to ₹29.70 Cr)

Issue Type: Fixed Price Issue IPO

Listing At: NSE SME

Shareholding preissue: 18,247,420

Shareholding postissue: 24,847,420

Market Maker Portion: 330,000 shares

Market Maker: Nnm Securities

ALUWIND ARCHITECTURAL IPO RESERVATION

Retail Shares Offered:

This category is designated for individual investors, often referred to as retail investors.

They are offered 50% of the Net Issue, meaning half of the total shares available for subscription in the IPO are allocated to retail investors.

This allocation is aimed at encouraging participation from individual investors who may not have large capital resources compared to institutional investors.

Other Shares Offered:

This category encompasses all other investor types, including institutional investors, high net worth individuals (HNIs), and others who are not classified as retail investors.

Similar to retail investors, this category is also offered 50% of the Net Issue, ensuring a fair distribution of shares among different investor groups.

This allocation helps maintain a balanced and inclusive approach to IPO subscription, allowing various types of investors to participate in the offering.

IPO Open Date (Thursday, March 28, 2024):

This marks the beginning of the Aluwind Architectural IPO subscription period. From this date onwards, investors can start subscribing to the IPO by placing their bids for shares.

IPO Close Date (Thursday, April 4, 2024):

This signifies the end of the subscription period for the Aluwind Architectural IPO. Investors must submit their bids before this date to participate in the IPO.

Basis of Allotment (Friday, April 5, 2024):

On this day, the basis of share allotment for the IPO is determined.

The allotment process involves allocating shares to investors based on various factors such as subscription levels, investor categories, and regulatory guidelines.

Initiation of Refunds (Monday, April 8, 2024):

Refunds for unsuccessful bids or excess funds are initiated on this day. Investors who did not receive full allotment or were not allotted any shares will receive refunds for the amount they subscribed.

Credit of Shares to Demat (Monday, April 8, 2024):

Shares allotted to investors are credited to their demat accounts on this day.

Dematerialization is the process of converting physical share certificates into electronic format, and shares are held in demat accounts for ease of trading and safekeeping.

Listing Date (Tuesday, April 9, 2024):

This marks the official listing of Aluwind Architectural IPO shares on the stock exchange.

The shares become available for trading on this date, and investors can buy and sell them in the secondary market.

Cutoff Time for UPI Mandate Confirmation (5 PM on April 4, 2024):

This is the deadline for confirming UPI mandates for IPO applications. UPI (Unified Payments Interface) mandates are required for online payments made through UPI apps for subscribing to the IPO.

Investors must confirm their UPI mandates before this cutoff time to ensure successful payment processing.

The Aluwind Architectural IPO Lot Size allows investors to bid for shares in specific quantities.

The below information illustrates the minimum and maximum investment requirements for both retail investors and High Net Worth Individuals (HNIs), expressed in terms of shares and the corresponding amount.

Retail Investors:

Minimum Investment:

Retail investors are required to bid for a minimum of 1 lot, equivalent to 3000 shares, with an investment amount of ₹135,000.

Maximum Investment:

Similarly, the maximum investment allowed for retail investors is also 1 lot, totaling 3000 shares, with an investment amount capped at ₹135,000.

High Net Worth Individuals (HNIs):

Minimum Investment: HNIs need to bid for a minimum of 2 lots, totaling 6000 shares, with an investment amount of ₹270,000.

This structure ensures that both retail investors and HNIs have clear guidelines on the quantity of shares they can bid for and the corresponding investment amounts.

It aims to facilitate fair participation in the IPO while accommodating investors with varying capital capacities.

The Aluwind Architectural IPO Promoter Holding details the ownership stakes held by the company’s promoters before and after the IPO.

The promoters of the company include Mr. Murli Manohar Ramshankar Kabra, Mr. Rajesh Kabra, Mr. Jagmohan Ramshankar Kabra, and Jagmohan Kabra HUF.

Share Holding Pre Issue:

Before the IPO, the promoters collectively hold 98.22% of the company’s shares. This indicates a significant ownership interest vested in the hands of the promoters prior to the public offering.

Share Holding Post Issue:

Following the IPO, the promoters’ collective ownership stake decreases to 72.13%. This reduction is a result of the issuance of new shares to public investors during the IPO process.

These figures provide insight into the extent of promoter ownership in the company both before and after the IPO, highlighting any changes in their ownership positions as a result of the public offering.