In this update, we outline the progress made during recent 12th Bipartite Settlement Discussions with IBA and the challenges that still need to be resolved.

12TH BIPARTITE SETTLEMENT UPDATE

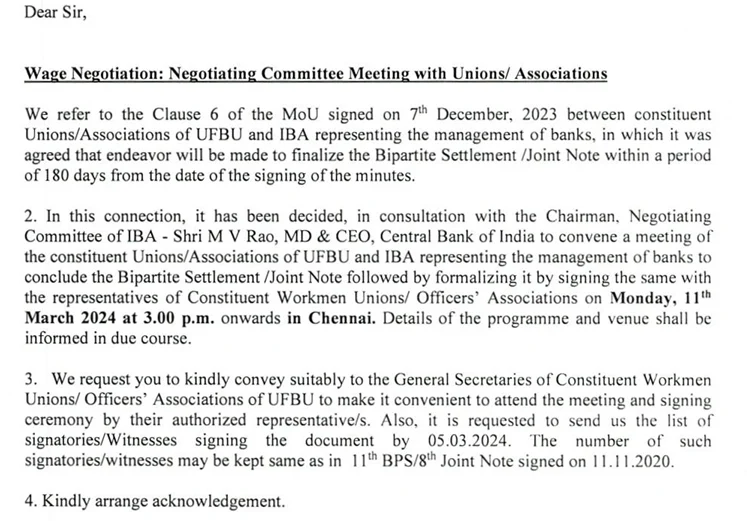

On March 4th, 2024, the Indian Banks Association (IBA) penned a letter to the United Forum of Bank Unions (UFBU) regarding Wage Negotiation, an important matter for bank employees.

This communication signifies the ongoing discussions and agreements between the two entities regarding the terms and conditions of wages for bank workers.

The letter referred to a Memorandum of Understanding (MOU) inked on December 7th, 2023, between UFBU and IBA.

This MOU outlined a mutual commitment to endeavor towards finalizing the Bipartite Settlement or Joint Note within 180 days from the date of signing the minutes.

Essentially, both parties had agreed to work towards reaching a consensus on wage-related matters within a stipulated timeframe.

Given the significance of this agreement, it was decided to convene a meeting on Monday, March 11th, 2024. The meeting is scheduled to commence at 3:00 pm and will take place in Chennai.

While the letter provided a preliminary announcement of the meeting, additional details regarding the agenda, venue, and other pertinent information would be communicated to the concerned parties in due course.

This communication underscores the ongoing dialogue and efforts between the Indian Banks Association and the United Forum of Bank Unions to address and resolve issues related to wage negotiations in the banking sector.

UFBU LETTER ON 04.03.2024

Video Credit: Know with hits.

12TH BIPARTITE SETTLEMENT UPDATE ON 07.12.2023

On the night of December 7th, the 12th Bipartite Settlement Memorandum of Understanding (MoU) was signed between the Indian Banks Association (IBA) and the United Forum of Bank Unions (UFBU), consisting of eight unions together with AIBOA separately. Here are some important points about this agreement:

- This MoU is unique because it was signed within 14 months after the expiration of the previous 11th Bipartite Settlement, without any protests. Normally, such agreements take around 24 months or more to be reached.

- The MoU was achieved in the fifth round of discussions that began in July 2023, a significant improvement compared to the 44 rounds required for the 11th Bipartite Settlement.

- Unlike the previous Bipartite Settlement that initially offered 0% to 2% increase, this MoU started with a 15% hike in the Pay slip component.

- The MoU provides a 17% increase in the Pay slip component, totaling Rs.12449 crores, along with monthly ex-gratia for pensioners and family pensioners.

- However, the IBA’s offer was conditional, and many core demands of the Unions and Associations were not addressed.

- Despite some positive aspects, the General Secretary of AIBOC, com. Rupam Roy, expressed reservations but emphasized the need to accept the MoU with a positive mindset.

- The MoU has both positive and negative features and does not address all the core issues raised by the Unions and Associations in Bipartite Settlement.

- The leaders of UFBU need to consider the expectations of bank employees and officers before signing the final settlement within 180 days from the date of the MoU.

- Key demands include merging Special Allowance with Dearness Allowance, increasing loading, updating pension, implementing “5 days banking”

- The MoU recognizes the demand for pension updation for all retirees but lacks a commitment from IBA on when this issue will be resolved.

- Other demands such as full pension after 20 years of service, last month’s pay for pension calculation, commutation adjustments, and scrapping NPS are not addressed in the MoU.

- The Unions and Associations stress the need to settle genuine demands and suggest using a portion of the written-off amount by commercial banks to meet wage increase aspirations if IBA/Government does not come forward.

IMPORTANT DEVELOPMENTS FROM TODAY’S MEETING (07.12.2023)

The implementation of 5 Day Banking is in its final stages, with imminent realization.

Despite the Indian Banking Association (IBA) proposing an 17% pay-in slip cost and a 3% load factor, unions have rejected the offer.

The upcoming meeting is scheduled for the conclusion of end of December 2023, signifying ongoing discussions and updates.

Follow our website for updates.

OLD MEETING DETAILS

Next talk between IBA and Union groups: December 7th, 3:30 pm

– Discussion on important matters

– Anticipation among people for the decisions

– Significant meeting for potential agreements on ongoing discussions

– Curiosity among bank employees about the outcomes

– Hope for positive decisions and progress

– Waiting to see the results on December 7th.

The wage negotiation held today failed to reach a conclusive agreement, primarily due to the offer presented by the Indian Banks’ Association (IBA).

The IBA proposed a wage increase of 16% in the pay slip cost, coupled with an additional 2.5% loading on the basic pay. Unfortunately, this proposition did not meet the expectations or demands of the concerned parties.

Employees and worker representatives had anticipated a more favourable outcome from the negotiation. They had sought higher wage increments to align with their expectations and the evolving economic conditions.

The IBA’s offer, although a step in the negotiation process, was perceived as falling short of addressing the aspirations and concerns of the workforce.

In summary, today’s wage negotiation, characterized by the IBA’s offer of a 16% increase in the pay slip cost and a 2.5% loading on the basic pay, concluded without a consensus.

Further deliberations and negotiations are expected as both parties work towards a more satisfactory resolution.

MEETINGS OF WORKING GROUPS

In the pursuit of a comprehensive understanding of the demands set forth in the Charter of Demands, various Working Groups have been convened.

These groups have been tasked with deliberating on specific issues. Here’s a summary of the discussions held by each Working Group:

SPECIAL PAY POSTS AND DUTIES

The Working Group addressing Special Pay posts and duties has been scrutinizing the demands and concerns related to these positions.

These deliberations aim to ensure fairness and transparency in compensating employees in specialized roles.

REVISED DA FORMULA

A crucial element of these discussions revolves around the revision of the Dearness Allowance (DA) formula.

The unions have advocated for the adoption of the 2016=100 Index Series as opposed to the outdated 1960=100 Index Series for calculating DA.

The Working Group has shown a willingness to recommend this change, marking a potential breakthrough.

DISCIPLINARY ACTION & PROCEDURES FOR WORKMEN

Workmen’s disciplinary procedures are under review in this Working Group.

The focus is on ensuring equitable and just disciplinary actions, thereby safeguarding the rights of employees. These discussions will contribute to a fair and transparent system.

OFFICERS DISCIPLINARY PROCEDURE CONDUCT RULES

Similar to the discussions on workmen, discussions on disciplinary procedures and conduct rules for officers aim to establish a framework that promotes fairness and consistency in dealing with disciplinary matters concerning officers.

LEAVE AND LFC RULES

The final Working Group has been deliberating on leave and Leave Fare Concession (LFC) rules.

These discussions are pivotal in addressing the unions’ concerns regarding employee leave and travel benefits.

CORE COMMITTEE MEETING (25-10-2023)

On October 25, 2023, a meeting of the Core Committee was held to consolidate the outcomes of the Working Groups’ discussions.

This meeting provided a comprehensive overview of the progress made and the key issues that still require resolution.

NEGOTIATING COMMITTEE MEETING (27-10-2023)

A critical meeting took place on October 27, 2023, where the Negotiating Committee of the IBA, led by Mr. M.V. Rao, Chairman and Managing Director of Central Bank of India, engaged in discussions with the union representatives.

This meeting marked an attempt to reach a consensus on the various demands presented by the labour unions.

DEMAND FOR IMPROVED OFFER

During this meeting, union representatives conveyed their concerns to the IBA. While the IBA offered an increase of 15% on the Payslip cost, the unions expressed their reservation, deeming the offer inadequate to conclude the negotiations.

Recognizing the financial constraints faced by the banks, the unions urged the IBA to enhance their offer to better address the demands of the employees.

CONTINUED DISCUSSIONS

The meeting on October 27, 2023, did not result in a final agreement. As such, discussions will persist until a mutual consensus is reached.

Both parties understand the importance of reaching an equitable settlement that accommodates the interests of the employees while taking into account the financial capacities of the banks.

Option for Resigned Employees to Join the Pension Scheme

In a significant development, the issue of extending an option to resigned or voluntarily retired employees and officers to join the pension scheme was brought up during the negotiations.

The IBA expressed their inclination to agree to this provision. It was decided that rules and conditions governing this option would be worked out in detail.

This development marks a positive step towards addressing the concerns of these individuals.

12TH BIPARTITE SETTLEMENT UPDATE CONCLUSION

The ongoing bipartite discussions between the banking sector labour unions and the IBA are pivotal in addressing the demands and concerns of bank employees.

While progress has been made, particularly in the revision of the DA formula and the possibility for resigned employees to join the pension scheme, challenges remain, particularly in reaching a consensus on the payslip cost increase.

ALSO READ : PM KISAN STATUS

As discussions continue, it is essential that both parties maintain an open dialogue to ensure the final settlement accommodates the interests of the employees and the practicalities of the banking sector.

These discussions have far-reaching implications for the banking industry and the welfare of the employees, making their resolution of utmost importance.