Dear Readers welcome, in this article we will provide information related to Kalyan Jewellers Share Price Target 2023 to 2030. Kalyan Jewellers is a leading company in the Indian jewellery business that has been rapidly expanding.

In the coming years, it is expected to show strong growth and potential. Let’s analyse the share price targets for Kalyan Jewellers for the upcoming years.

KALYAN JEWELLERS SHARE PRICE TARGET 2023

Kalyan Jewellers is a prominent player in the organized jewellery business in India. They are involved in every aspect of jewellery, from designing to manufacturing and sales.

The company collaborates with local artisans to create unique designs, which helps them establish a strong presence in the retail market.

With the company expanding its showrooms under the “My Kalyan” name in various regions, it’s poised to connect with more local retail customers easily.

As the company extends its reach in various regions, the share price target for 2023 is expected to reach Rs 350, with a subsequent target of Rs 360.

KALYAN JEWELLERS SHARE PRICE TARGET 2024

Kalyan Jewellers is making efforts to strengthen its position in the jewellery business all over India. The company is appointing prominent actors and actresses as brand ambassadors, which enhances its brand value and encourages customers to purchase Kalyan Jewellers products.

In recent years, the company has focused on advertising investments to build its brand value in the jewellery segment. As the company continues to enhance its brand value, it is expected to yield good returns in 2024, with the share price target reaching Rs 400 and a subsequent target of Rs 420.

KALYAN JEWELLERS SHARE PRICE TARGET 2025

Kalyan Jewellers is consistently expanding its business presence throughout India, striving to enhance its distribution network.

With showrooms in nearly every state in the country and showrooms in more than 30 locations in 5 Middle Eastern countries, the company is establishing a strong foothold.

Additionally, as people are increasingly inclined to shop online, Kalyan Jewellers is also expanding into online platforms. As the company’s distribution network strengthens, business grows, and the brand value increases, it is expected that in 2025, the share price target will be around Rs 450, with a subsequent target of Rs 460.

ALSO READ: BHARTI AIRTEL SHARE PRICE TARGET

KALYAN JEWELLERS SHARE PRICE TARGET 2026

Kalyan Jewellers offers excellent services and features to maintain a good relationship with customers. By providing services like price transparency and BIS Hallmark Gold, the company has gained the trust of customers, leading to increased sales.

The company also introduces exceptional designs in response to customer demands, which further attracts customers.

As Kalyan Jewellers launches new designs in the market, its business is expected to grow significantly, reflecting in its share price. In 2026, the share price target is likely to be around Rs 480, with a subsequent target of Rs 500.

KALYAN JEWELLERS SHARE PRICE TARGET 2030

As you observe India’s organized jewellery market over a long period, it becomes evident that there is a significant opportunity.

Even now, the majority of the jewellery market is in the hands of unorganized players, which is why Kalyan Jewellers sees substantial opportunities to increase its market share.

While people are slowly showing confidence in organized companies like Kalyan Jewellers, this is leading to annual growth in the company’s market share, thanks to its rapid expansion.

As people’s lifestyles change and they prefer to buy branded products and purchase jewellery at brand showrooms, analysts believe that the organized market share is expected to grow by nearly 19% each year in the coming years.

This growth will benefit branded players like Kalyan Jewellers the most.

Looking at the increasing market share year by year, it is likely that Kalyan Jewellers’ share price could reach around Rs 550 by 2030.

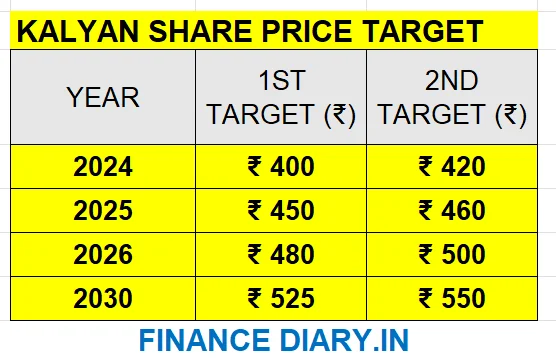

Kalyan Jewellers Share Price Targets for 2023, 2024, 2025, 2026, 2030:

First Target 2023: Rs 350

Second Target 2023: Rs 360

First Target 2024: Rs 400

Second Target 2024: Rs 420

First Target 2025: Rs 450

Second Target 2025: Rs 460

First Target 2026: Rs 480

Second Target 2026: Rs 500

Target for 2030: Rs 550

Video Credit: Share Market Advisor

FUTURE OF KALYAN JEWELLERS SHARE

Looking to the future, Kalyan Jewellers is strengthening its brand value rapidly.

This indicates that the company is likely to experience significant growth in its business in the coming years. Shareholders are expected to benefit from this growth.

KALYAN JEWELLERS SHARE PRICE TARGET RISKS

The biggest risk in Kalyan Jewellers’ business is its increasing debt every year. If the company does not successfully control its debt in the near future, it could negatively impact the business.

Another significant risk is the fluctuating gold prices, which can affect the company’s profits and losses.

Thirdly, Kalyan Jewellers is currently operating with relatively low profit margins. As the company improves its profit margins in the future, there is a slight risk of the share price decreasing.

OUR INFORMATION KALYAN JEWELLERS SHARE PRICE TARGET

Kalyan Jewellers is a company that is growing rapidly in its business segment.

However, investors should not ignore its risks. If you are considering long term investment in this stock, always keep an eye on its financial results.

Invest in this stock when the company gradually demonstrates better financial performance. But remember, before making any investment decisions, consult your financial advisor.

KALYAN JEWELLERS SHARE PRICE TARGET FAQS

How will Kalyan Jewellers perform in the future?

The future of Kalyan Jewellers’ share depends on how the management makes decisions to capture the significant opportunities that lie ahead.

Is Kalyan Jewellers a debt free company?

No, Kalyan Jewellers has a significant amount of debt.

Does Kalyan Jewellers pay good dividends?

Kalyan Jewellers has not been known for paying significant dividends.

I hope this article has given you insights into Kalyan Jewelers future prospects along with details about the business.

If you have any more questions related to stock market investments, feel free to comment below.