In this article we will provide you the complete information related to the Best Fuel Credit Cards in India. As fuel prices continue to go up, many people are on the lookout for credit cards that can ease the burden of their fuel expenses.

While many cards provide a monthly fuel surcharge waiver, some are tailored specifically to address your fuel-related needs.

These cards offer savings through cashback, extra reward points, co-branded advantages, and more. Leading card issuers such as SBI Card, HDFC Bank, and Axis Bank provide some of the top fuel credit cards in India.

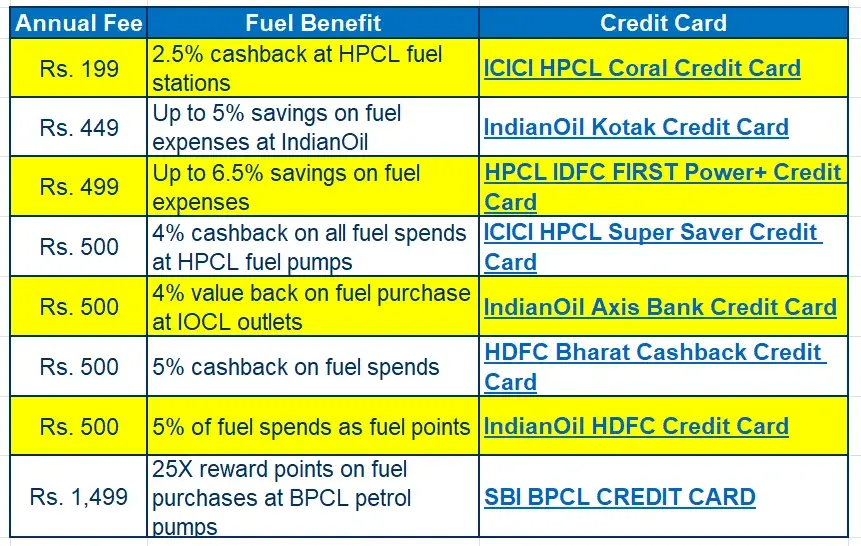

BEST FUEL CREDIT CARDS ANNUAL FEE, BENEFITS

ICICI BANK HPCL CORAL CREDIT CARD

The ICICI Bank HPCL Coral credit card is one of the best fuel credit cards. It is a partnership between ICICI Bank and HP fuel stations.

With this card, you earn both cashback and Payback points on your purchases, especially when you buy fuel at HP outlets, where you get a 2.5% cashback.

For every ₹100 spent, you earn five Payback points. You can use these points to get free fuel – redeeming 2,000 Payback points gives you fuel worth ₹500. Here are some additional perks:

- Five Payback points for every ₹100 spent on purchases.

- 15% savings at various dining outlets.

- Discounts on booking tickets through Book My Show.

- No interest charges for the first 48 days.

- Complimentary access to airport lounges.

The card charges ₹199 + taxes as annual fees, but it’s free for the first year. The Annual Percentage Rate (APR) is 40.80% or 3.40% per month.

If you make your ICICI Bank credit card payment through CRED, you can earn additional rewards.

SBI BPCL CARD OCTANE

The SBI BPCL Credit Card Octane not only caters to your fuel needs with attractive rewards and surcharge waivers but also extends its benefits to various lifestyle expenditures. From dining out to enjoying movies, this card offers a well-rounded approach to rewards and perks.

Additionally, the welcome bonus and airport lounge access enhance the overall cardholder experience, making it a compelling choice for those looking to maximize their benefits.

Fuel credit cards Costs:

Joining Fee: Rs. 1,499

Annual Fee: Rs. 1,499 (Can be waived off by spending Rs. 2 lakh in the previous year)

BPCL SBI Card Octane stands out as a premium variant of the BPCL SBI Card, offering enhanced advantages. Let’s delve into the features that make this card a compelling choice:

Fuel credit cards Benefits:

Reward Points on Fuel:

Earn a generous 25 reward points for every Rs. 100 spent on BPCL Fuel, Lubricants & Bharat Gas. This applies specifically to transactions made on the website and app.

Fuel Surcharge Waiver:

Enjoy a substantial 6.25% + 1% fuel surcharge waiver on each transaction, up to Rs. 4,000. This benefit is applicable at all BPCL petrol pumps across India.

Other Benefits:

Diverse Rewards:

Acquire 10 reward points for every Rs. 100 spent at dining outlets, departmental stores, grocery shopping, and movie expenses.

General Retail Purchases:

Gain 1 reward point for every Rs. 100 spent on other retail purchases. Note that this excludes mobile wallet uploads and non-BPCL fuel spends.

Welcome Bonus:

Start your journey with a warm welcome – receive a welcome bonus of 6,000 reward points. This is equivalent to a substantial Rs. 1,500 and helps kickstart your rewards.

Airport Lounge Access:

Enjoy a touch of luxury with 4 complimentary visits per calendar year to domestic VISA lounges in India. Traveling becomes a more comfortable experience.

Partner Brand Vouchers:

Unlock exclusive benefits with gift vouchers worth Rs. 2,000 from partner brands. This becomes accessible based on your annual spends, particularly when you reach Rs. 3 lakh in a year.

Financial Considerations on fuel credit cards

The card has a minimal joining fee of Rs. 1,499 and an annual fee of the same amount, which can be waived off by demonstrating significant spending – Rs. 2 lakh in the previous year.

INDIAN OIL CITI PLATINUM CARD

The Indian Oil Citi Platinum card is a collaboration between Indian Oil and Citibank, aiming to provide a straightforward and rewarding credit card experience.

The Indian Oil Citi Platinum card is designed to make your fuel purchases more rewarding, offering a clear points system that translates into tangible fuel benefits.

With additional perks in supermarket spending, general purchases, and exclusive privileges, this card is a practical choice for those seeking simplicity and value in their credit card experience.

Fuel Rewards:

Earn four turbo points (TP) for every ₹150 spent on fuel purchases at any IndianOil outlet.

Maximum earning in a single transaction is capped at 267 points.

Each TP is equivalent to ₹1 worth of fuel.

Additional Benefits:

Receive ₹250 worth of free TP upon successful card activation.

Gain two TP for every ₹150 spent on supermarket or grocery purchases.

Earn one TP for every ₹150 spent on other purchases.

Exclusive Privileges:

Access special dining discounts and privileges.

Enjoy travel discounts to enhance your journeys.

Redemption Options:

Redeem accumulated TPs for gift vouchers.

However, keep in mind that a minimum of 250 points is required for redemption.

Financial Details:

The card comes with an annual fee of ₹1,000 + taxes. Fortunately, this fee is waived if you spend more than ₹30,000 in a year.

The Annual Percentage Rate (APR) is a reasonable 39%, translating to a monthly interest rate of 3.25%.

Activation Bonus and Payment:

Receive a bonus of ₹250 worth of TP upon activating your card successfully.

Simplify your credit card management by making Citibank credit card payments through CRED.

INDIAN OIL HDFC BANK CREDIT CARD

If you are someone who frequently fills up at Indian Oil outlets, the Indian Oil HDFC Bank Credit Card might be the perfect fit for you.

This card lets you earn Fuel Points (FP) every time you spend on fuel, making it a great choice for those looking to save on their fuel expenses.

How it works:

For every ₹150 you spend on fuel at any Indian Oil outlet, you earn one Fuel Point. During the initial six months of card membership, you can accumulate up to 250 Fuel Points, and thereafter, up to 150 Fuel Points per month.

The exciting part is that each Fuel Point is equivalent to ₹0.20, effectively giving you up to 5% cashback on your fuel purchases.

It’s worth noting that Fuel Points come with a two-year expiry period from the time of accumulation, so it’s advisable to keep an eye on their validity.

Additional benefits:

Apart from fuel-related perks, the Indian Oil HDFC Bank Credit Card offers more advantages:

- Earn 1 FP for every ₹150 spent on credit card bill payments and groceries.

- Automatic registration for PayZapp on the first transaction of ₹500 within 90 days.

- No interest charges for the first 50 days.

- No annual fees if you register with SmartPay within 90 days.

- Card charges: ₹500 + taxes annual fees, waived if you spend ₹20,000 within the first 90 days. From the second year onwards, the annual fee is waived off if you spend more than ₹50,000 in a year.

- APR of 41.88% or 3.49% per month.

Payment Convenience:

To make things even more convenient, you can make your HDFC credit card payment via CRED. This platform not only simplifies the payment process but also offers various rewards and benefits for credit card payments.

Considerations:

- Keep in mind the relatively high APR, emphasizing the importance of paying off your balance in full monthly to avoid interest charges.

- While the annual fee can be waived with specific spending requirements, factor in this fee when deciding if the card suits your needs.

TATA STAR TITANIUM CREDIT CARD

The TATA Star Titanium credit card is the latest fuel credit cards in India offered by the TATA group. Here’s what you get:

In this you will be earning one point for every ₹100 spent on purchases.

Enjoy a 1% fuel surcharge waiver on transactions over ₹500.

Your points have value – one point equals a ₹1 TATA voucher, which you can redeem for offers and discounts from TATA partners. Here are some added perks:

- Three points per ₹100 spent on groceries and online shopping.

- 5% cashback on purchases at TATA outlets.

The card charges ₹499 + taxes as annual fees, but if you spend more than ₹1 lakh, this fee is waived. The Annual Percentage Rate (APR) is 40.2%, or 3.35% per month.

YES BANK FIRST PREFERRED CREDIT CARD

The YES First Preferred credit card, issued by YES Bank, offers a plethora of benefits and rewards, making it an enticing choice for discerning individuals seeking to elevate their financial experience.

This card stands out with its lucrative rewards program, comprehensive insurance coverage, and exclusive privileges, catering to a wide range of lifestyles and spending patterns.

Fuel Rewards:

Fuel expenses often form a significant portion of an individual’s monthly spending. To address this, the YES First Preferred credit card rewards cardholders with 4 points for every ₹100 spent on fuel purchases at any fuel outlet.

These accumulated points can be redeemed for a variety of exciting gifts, discounts, and privileges, effectively offsetting fuel costs and enhancing overall savings.

Travel Rewards:

For frequent travelers, the YES First Preferred credit card presents an array of travel-centric benefits. Cardholders earn 8 points for every ₹100 spent on travel and airline bookings, enabling them to accumulate points at an accelerated pace.

These points can be redeemed for flight upgrades, hotel accommodations, and other travel-related expenses, transforming every journey into a rewarding experience.

Entertainment Rewards:

Entertainment enthusiasts can rejoice, as the YES First Preferred credit card unlocks a world of cinematic delights. Cardholders enjoy a remarkable 25% discount on movie tickets from BookMyShow, India’s leading online movie ticketing platform.

This exclusive offer allows cardholders to indulge in their passion for movies while saving significantly on ticket costs.

Airport Lounge Access:

Frequent travelers can relish the convenience and comfort of airport lounge access with the YES First Preferred credit card. Primary cardholders are granted Priority Pass membership, providing access to over 1,300 airport lounges worldwide.

Additionally, cardholders enjoy domestic lounge access at Indian airports, ensuring a seamless and hassle-free travel experience.

Bonus Rewards:

The YES First Preferred credit card goes beyond the ordinary by offering a multitude of bonus rewards. Cardholders can earn a staggering 20,000 points for spending more than ₹7.5 lakhs, demonstrating the card’s commitment to rewarding its loyal customers.

Additionally, a bonus of 10,000 points is awarded upon card renewal, further enriching the rewards experience.

Welcome Bonus and Auto-Bill Payment Rewards on Fuel credit cards

New cardholders are welcomed with a generous signup bonus of 15,000 points upon their first transaction within 90 days.

This substantial bonus sets the tone for a rewarding journey with the YES First Preferred credit card. Furthermore, cardholders are rewarded for their financial responsibility with a bonus of 1,000 points for setting up each auto-bill payment.

Insurance Coverage:

The YES First Preferred credit card prioritizes the well-being of its cardholders by providing comprehensive insurance coverage. In the unfortunate event of a flight accident, cardholders are covered by ₹1 crore death insurance, offering financial security and peace of mind.

Additionally, cardholders enjoy ₹25 lakh medical insurance coverage for hospital emergencies overseas, ensuring they are well-protected during their travels.

Annual Fees and APR:

The YES First Preferred fuel credit cards is associated with an annual fee of ₹2500 + taxes. Additionally, the card carries an APR of 42% or 3.5% per month.

It is crucial to consider these factors when evaluating the overall cost of the card and ensuring it aligns with one’s financial situation and spending habits.

Payment Options:

Cardholders can conveniently make their YES First Preferred credit card payments through CRED, a leading credit card payment platform. By utilizing CRED, cardholders can earn additional rewards, further enhancing the value proposition of the card.

UNDERSTANDING FUEL CREDIT CARDS IN SIMPLE TERMS

A Fuel Credit Card is a special card provided by banks to customers who frequently purchase fuel. The purpose is to offer maximum benefits and reduce expenses related to fuel. This card not only helps in saving money on fuel but also provides additional lifestyle-related advantages.

HOW TO GET A FUEL CREDIT CARDS?

To apply for a Fuel Credit Card, you can visit the nearest bank branch or apply online. Simply fill out the application form and submit the required documents. This process allows you to obtain a Fuel Credit Card, giving you the advantage of cutting down on fuel costs.

WHO CAN APPLY FOR A FUEL CREDIT CARDS?

Eligibility criteria for a fuel credit card may vary among banks. However, some common requirements include:

Maintaining a good credit score.

Meeting the minimum age and income criteria set by the bank.

By fulfilling these criteria, individuals can apply for a Fuel Credit Card and enjoy its benefits.

ADVANTAGES OF HAVING A FUEL CREDIT CARDS

Fuel credit cards come with various benefits, and these perks can vary depending on the card issuer. Here are some common advantages associated with fuel credit cards:

Cashback or Reward Points

Many fuel credit cards provide direct discounts or cashback on fuel transactions. Some offer extra reward points for every fuel purchase. These points can be redeemed for free fuel, cashback, gift vouchers, and more. Some cards even offer bonus rewards for fuel transactions at specific outlets.

Redemption Options

Fuel credit cards not only offer higher rewards on fuel expenses but also allow you to redeem earned points for future fuel purchases. For example, the IndianOil HDFC Credit Card enables you to get free fuel, up to 50 litres annually, by earning and redeeming reward points.

Co-branded Benefits

Most fuel credit cards are co-branded, meaning they provide enhanced benefits at specific partnered brands. For instance, the BPCL SBI Card Octane offers a value back of up to 7.25% for purchases at BPCL outlets. It’s essential to choose a credit card that provides higher rewards or cashback at your preferred fuel stations.

Complimentary Benefits

In addition to basic benefits, some cards offer complimentary perks like memberships, bonus rewards for achieving spending milestones, and more. For example, the IndianOil HDFC Credit Card includes a complimentary IndianOil XTRAREWARDSTM Program (IXRP) membership, allowing you to maximize your savings at IndianOil outlets.

THINGS TO THINK ABOUT BEFORE GETTING A FUEL CREDIT CARDS

When thinking about getting a Fuel Credit Cards, here are a few important things to consider:

Surcharge Waiver

Check if the card offers a surcharge waiver. This means you might not have to pay extra fees when buying fuel using the card.

Credit Limit

Understand the credit limit of the card. This will be the maximum amount you will be spending using the card. Make sure it fits your needs.

Annual Fee

Find out if there is an annual fee for using the Fuel Credit Cards. Some cards may charge a yearly fee for their services. Consider if it’s worth it for you.

Video Credit: Card Academy

FINAL WORDS ON BEST FUEL CREDIT CARDS

Dear readers by reading this article you got the information about Best Fuel Credit Cards. These credit cards offer a lots of benefits to help you significantly reduce your annual fuel expenses. These cards not only provide generous cashback and reward points but also offer additional perks such as complimentary fuel surcharges and exclusive discounts.

Furthermore, by linking these Fuel Credit Cards with CRED, you can unlock a whole new level of savings, gaining access to cashback multipliers, exciting rewards, and even surprise gifts.

With these cards you can effectively transform your fuel purchases into rewarding experiences, maximizing your savings while enjoying a host of valuable benefits.